44 coupon vs interest rate

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S. Treasury... Coupon Rate Formula & Calculation | Coupon Rate vs. Interest Rate ... Coupon rate refers to the fixed interest payments paid by the bond issuer and will be the same during the life of the bond. On the other hand, market interest rates might rise or fall and...

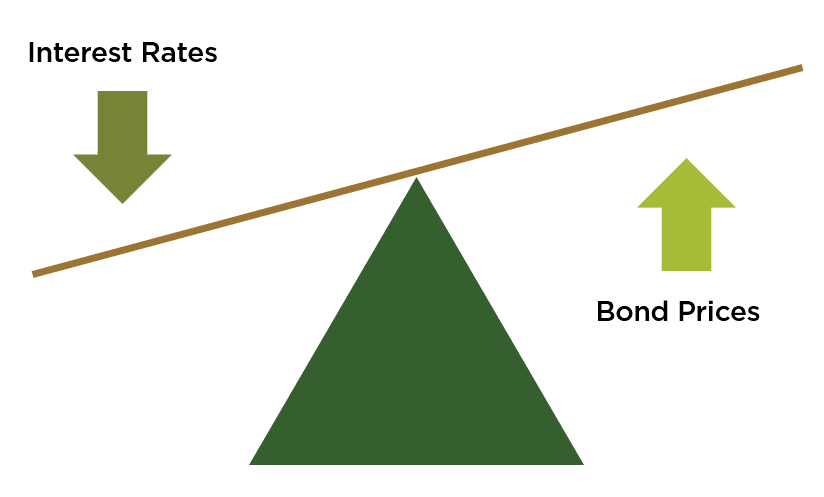

Bond Coupon Interest Rate: How It Affects Price - Investopedia 18.12.2021 · Coupon Interest Rate vs. Yield . Most bonds have fixed coupon rates, meaning that no matter what the national interest rate may be—and regardless of market fluctuation—the annual coupon ...

Coupon vs interest rate

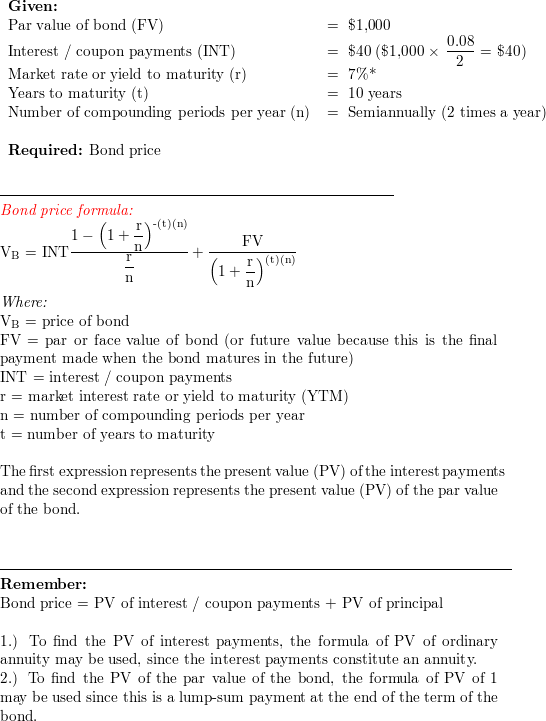

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Thus, a $1,000 bond with a coupon rate of 6% pays $60 in interest annually and a $2,000 bond with a coupon rate of 6% pays $120 in interest annually. Key Takeaways Coupon rates are the... Important Differences Between Coupon and Yield to Maturity - The Balance To put all this into the simplest terms possible, the coupon is the amount of fixed interest the bond will earn each year—a set dollar amount that's a percentage of the original bond price. Yield to maturity is what the investor can expect to earn from the bond if they hold it until maturity. Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

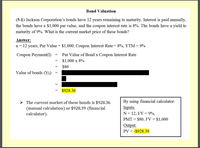

Coupon vs interest rate. Bond: Financial Meaning With Examples and How They Are Priced 01.07.2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... What is difference between coupon rate and interest rate? What is the difference between a coupon rate and an interest rate in a bond? The coupon rate is the rate the bond at 100% face of value the bond, usually $10,000. But as interest rates change in the marketplace, the real value and interest rate of the bond will change. Let's say a 20-year bond comes out at 3.0%. Difference Between Coupon Rate and Discount Rate Coupon rates are generally affected by the loan fees set by the government.1 Subsequently, on the off chance that the public authority expands the base financing cost to 6%, any previous securities with coupon rates beneath 6% lose esteem. The coupon rate is communicated as a level of its standard capital. Coupon Rate vs. Discount Rate - What's The Difference (With Table) The main difference between a coupon rate and a discount rate lies in how the rates are charged and the factors upon which the rates depend. A coupon rate can be described as the annual rate of interest that the bond issuer pays to the bondholder on the fixed income security whereas a discount rate can be defined as the rate of interest chosen by the bank, paid to the lender by the borrower and is directly affected by the general economic conditions.

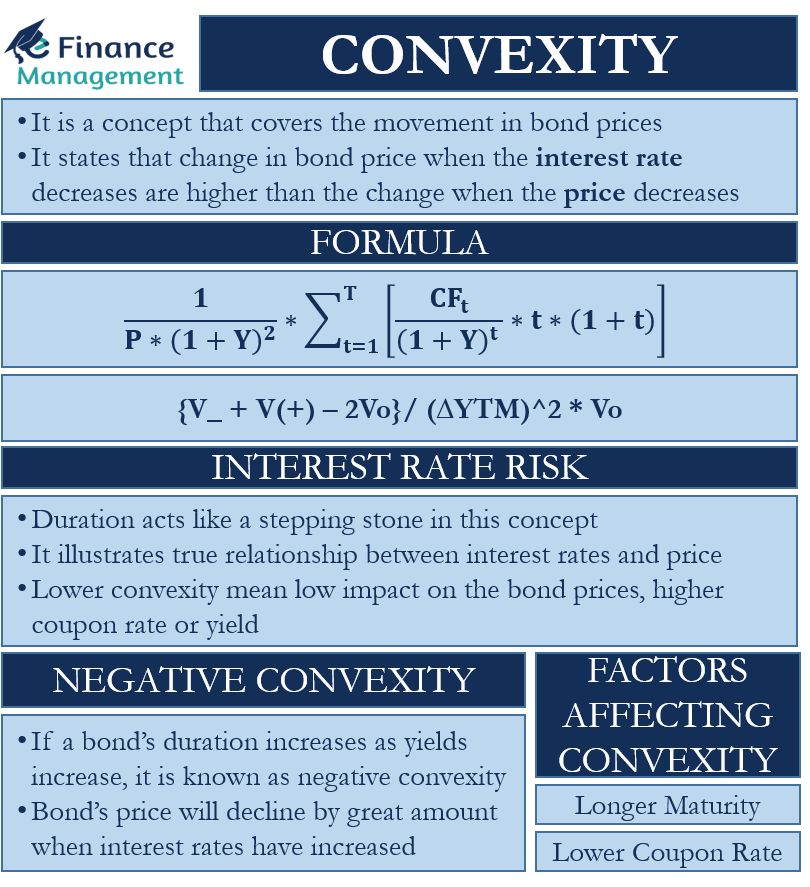

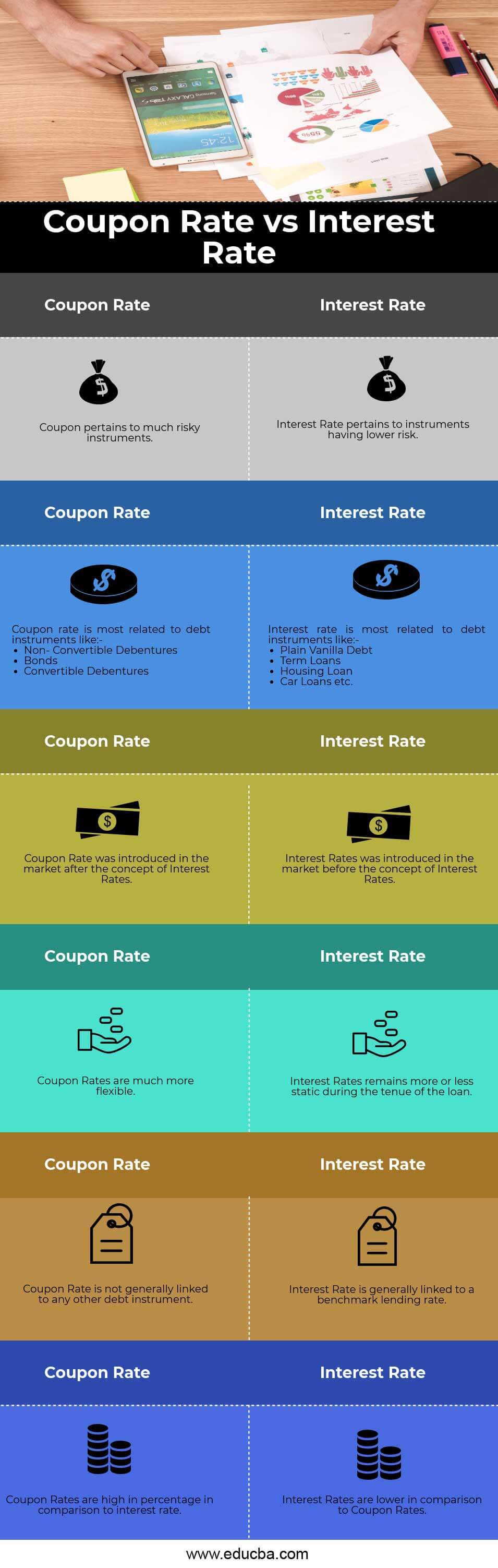

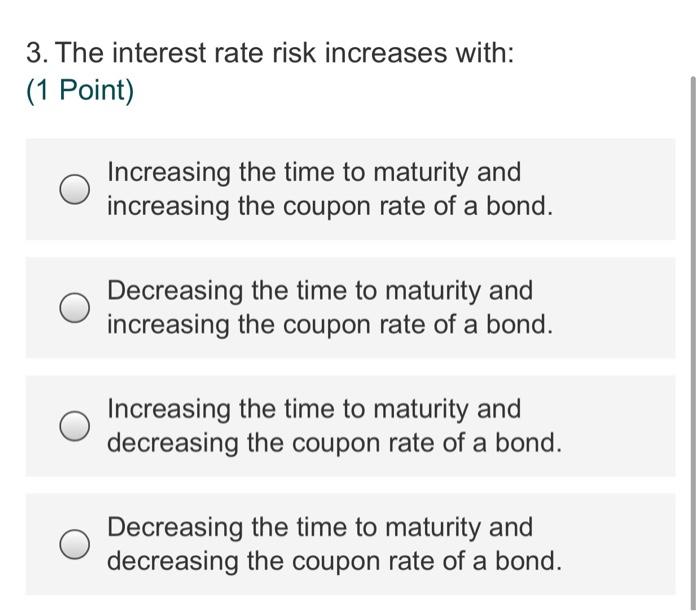

Coupon Rate Definition 05.09.2021 · Changing market interest rates affect bond investment results. Since a bond's coupon rate is fixed all through the bond's maturity, a bondholder is stuck with receiving comparably lower interest ... Of coupons, yields, rates and spreads: What does it all mean? - YieldStreet A coupon is a fixed cash payment the investor is promised on a bond, usually expressed as a percent of the par value - which is also known as the principal. Yield and rate of return are both dynamic values that describe the performance of a bond over a set period of time. While the rate of return on an investment is the percentage increase over the initial investment cost, a yield is a measure that shows how much income has been returned from an investment based on initial cost at any ... What Is the Coupon Rate of a Bond? - The Balance 18.11.2021 · Coupon Rate vs. Yield . In contrast to the bond’s coupon rate, which is a stated interest rate based on the bond’s par value, the current yield is a measurement of the dollar amount of interest paid on the bond compared to the price at which the investor purchased the bond. In other words, the current yield is the coupon rate times the ... Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA The coupon Rate is not generally linked to any other debt instrument. Interest Rate is ...

CD Rate and APY: What's the Difference? | Fox Business In today's low interest-rate environment, the difference between the APY and the nominal rate is only a few hundredths of a percentage point. Using Bankrate's tool for comparing CD rates,... Discount Rate vs Interest Rate | 7 Best Difference (with ... - EDUCBA After examining the above information, we can say that Discount Rate vs Interest Rate is two different concepts. A discount rate is a broader concept of Finance which is having multi-definitions and multi-usage. Whereas Interest rate has a narrow definition and usage, however, multi things are to consider before determining the interest rates. In some cases, you have to … Coupon Rate vs. Interest Rate - What's The Difference (With Table) Coupon rates change from time to time as they are more volatile, while interest rates are usually fixed and remain constant since it is decided by the lender alone. The coupon rate is applied on debt instruments like debentures and bonds, while interest rates are used on any types of loans availed from banks, financial institutions, or individuals. Coupon Rate vs Interest Rate | Top 8 Best Differences (with … Coupon Rate vs. Interest Rate – Key Differences. The key differences between Coupon Rate vs. Interest Rate are as follows – The coupon rate is calculated on the face value of the bond Value Of The Bond Bonds refer to the debt instruments issued by governments or corporations to acquire investors’ funds for a certain period. read more, which is being invested.

Difference Between Coupon Rate and Interest Rate Main Differences Between Coupon Rate and Interest Rate. Coupon rates are calculated on the ...

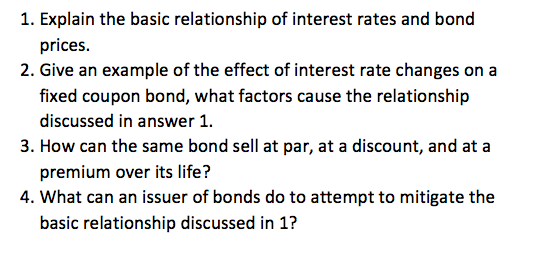

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held …

Interest rate - Wikipedia For an interest-bearing security, coupon rate is the ratio of the annual coupon amount (the coupon paid per year) per unit of par value, whereas current yield is the ratio of the annual coupon divided by its current market price. Yield to maturity is a bond's expected internal rate of return, assuming it will be held to maturity, that is, the discount rate which equates all remaining cash ...

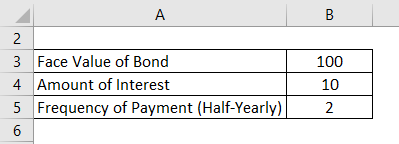

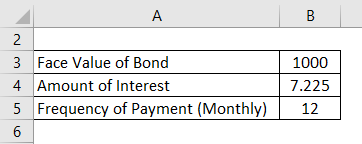

Yield to Maturity vs. Coupon Rate: What's the Difference? 20.05.2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ...

Difference Between Coupon Rate and Interest Rate What is the difference between Coupon Rate and Interest Rate? • Coupon Rate is the yield of a fixed income security. Interest rate is the rate charged for a borrowing. • Coupon Rate is calculated considering the face value of the investment. Interest rate is calculated considering the riskiness of the lending. • Coupon rate is decided by the issuer of the securities. Interest rate is decided by the lender.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

Important Differences Between Coupon and Yield to Maturity - The Balance To put all this into the simplest terms possible, the coupon is the amount of fixed interest the bond will earn each year—a set dollar amount that's a percentage of the original bond price. Yield to maturity is what the investor can expect to earn from the bond if they hold it until maturity.

Bond Yield Rate vs. Coupon Rate: What's the Difference? - Investopedia Thus, a $1,000 bond with a coupon rate of 6% pays $60 in interest annually and a $2,000 bond with a coupon rate of 6% pays $120 in interest annually. Key Takeaways Coupon rates are the...

Post a Comment for "44 coupon vs interest rate"