44 zero coupon bond face value

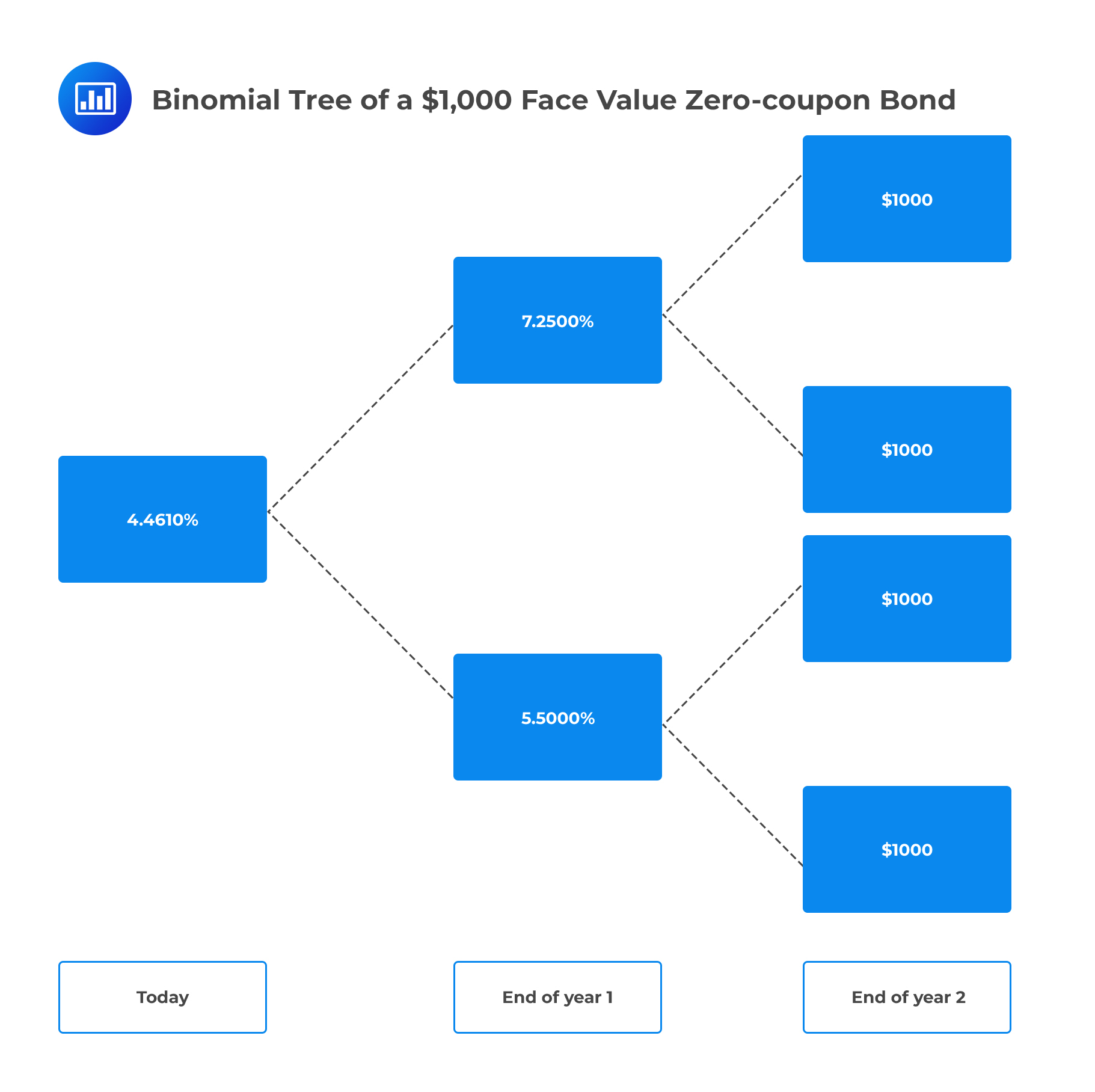

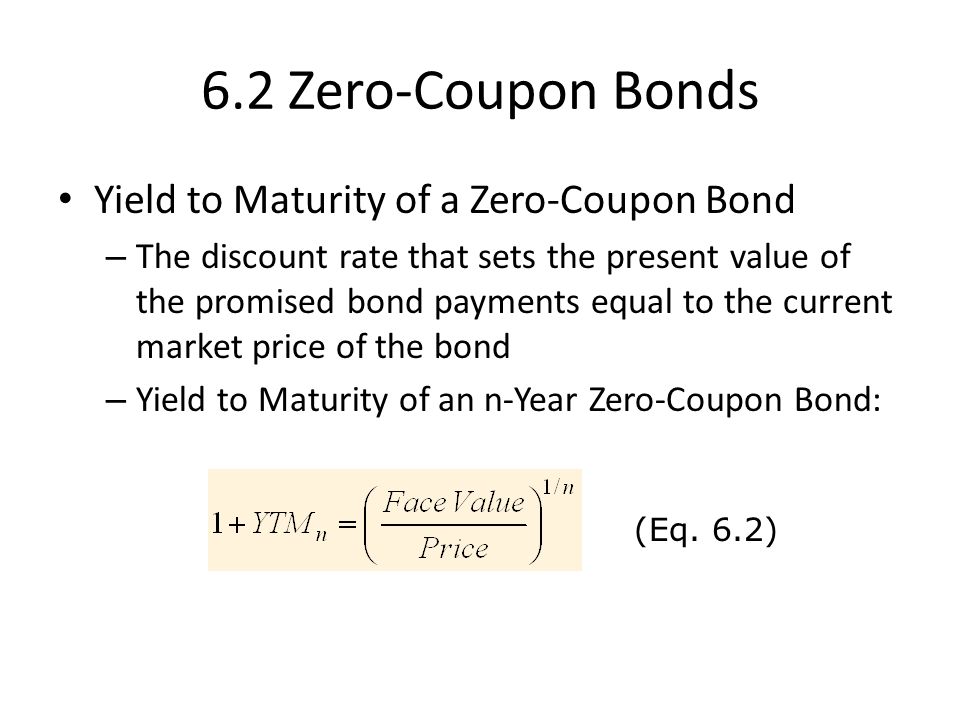

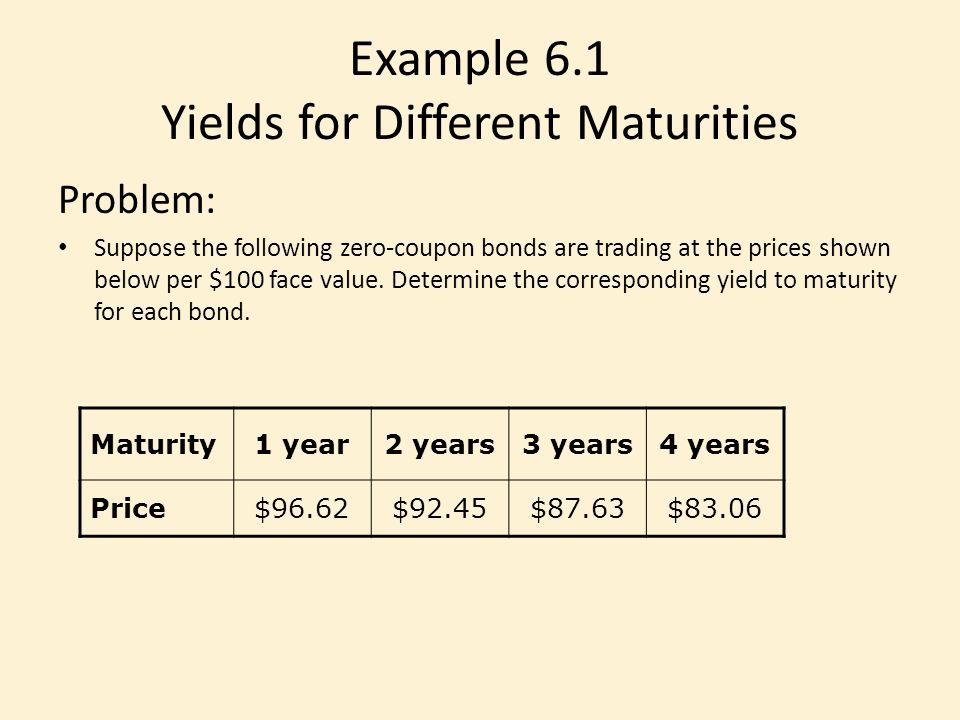

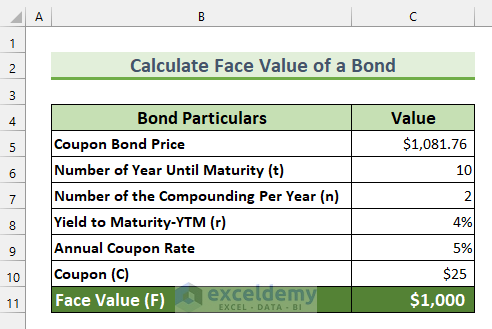

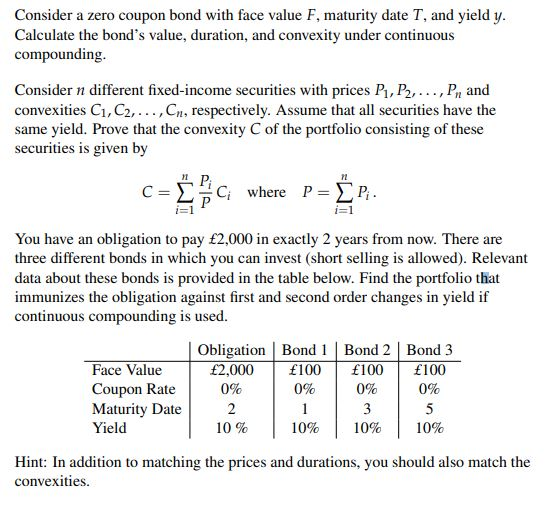

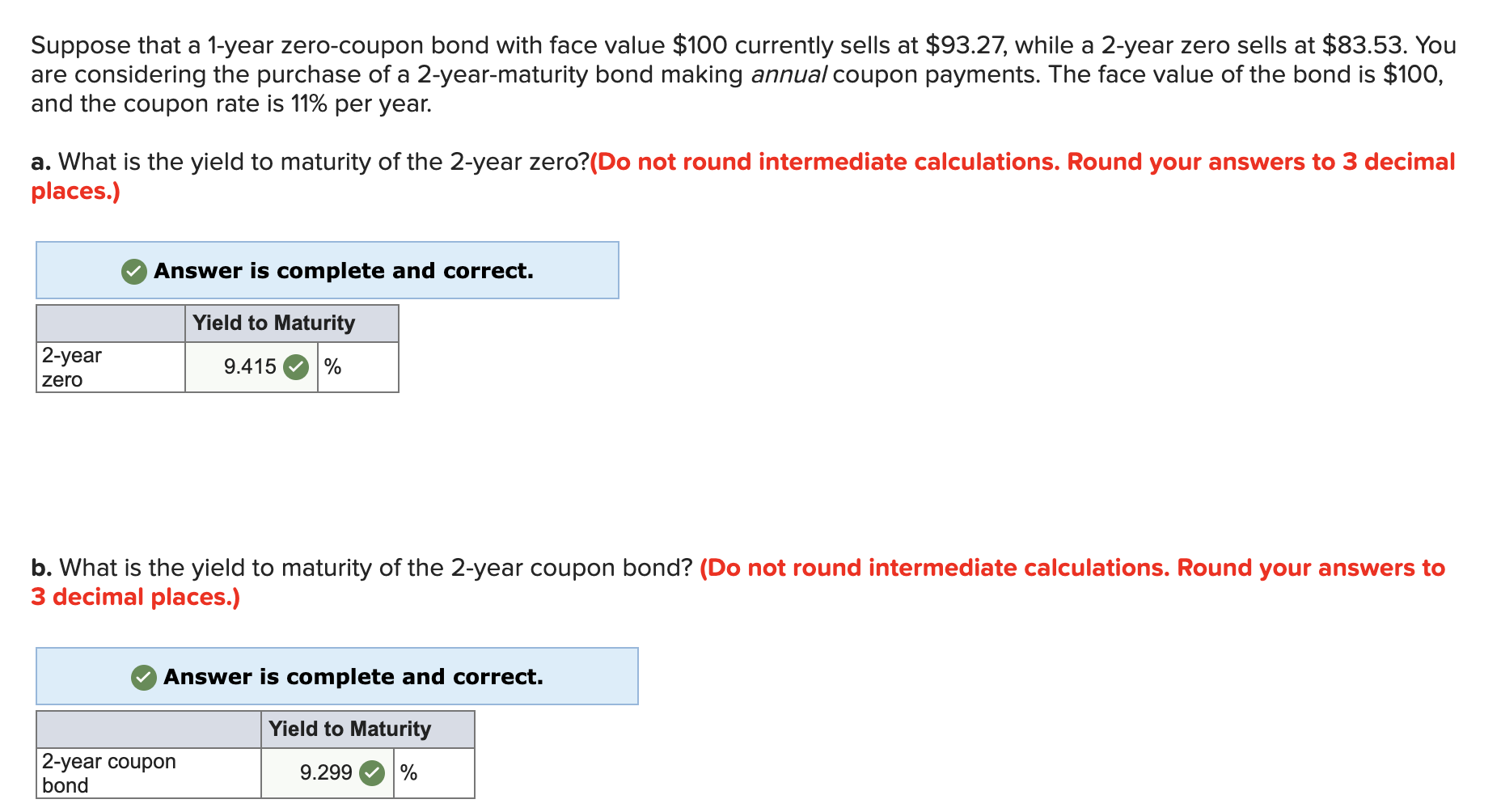

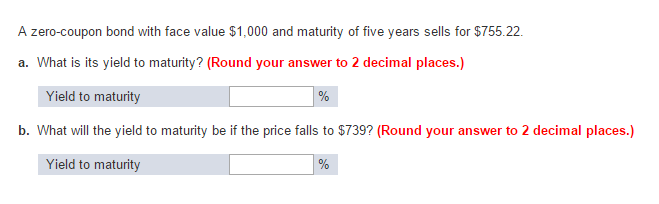

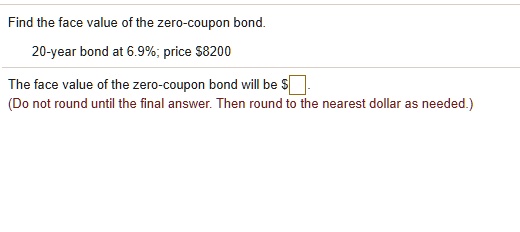

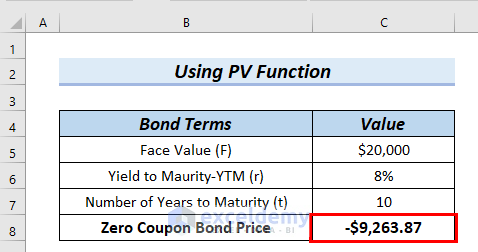

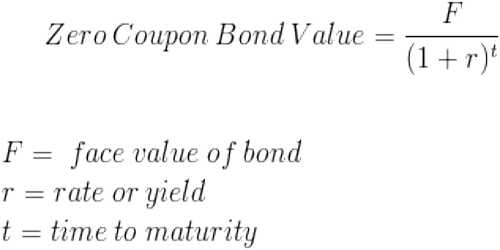

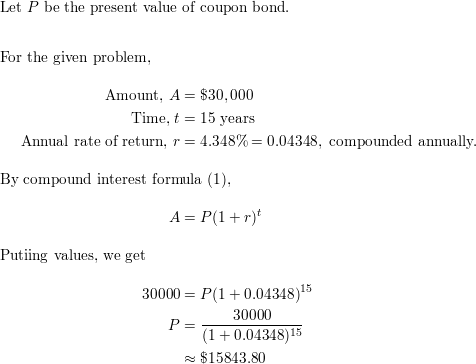

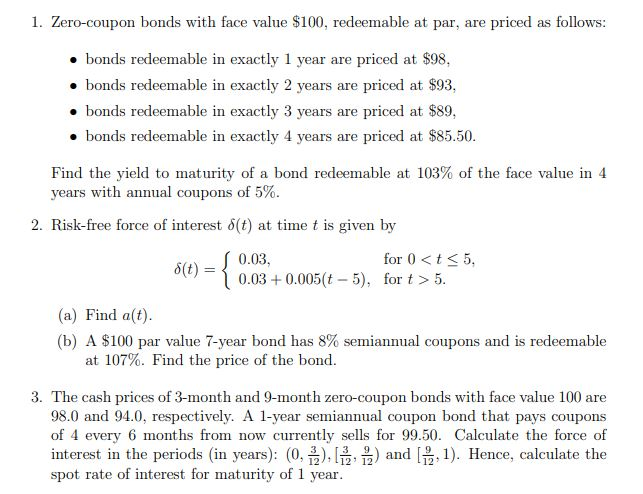

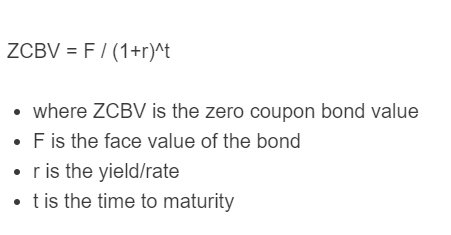

› zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. › articles › bondsUnderstanding Bond Prices and Yields - Investopedia Jun 28, 2007 · If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond. ... How to Calculate Yield to Maturity of a Zero-Coupon Bond ...

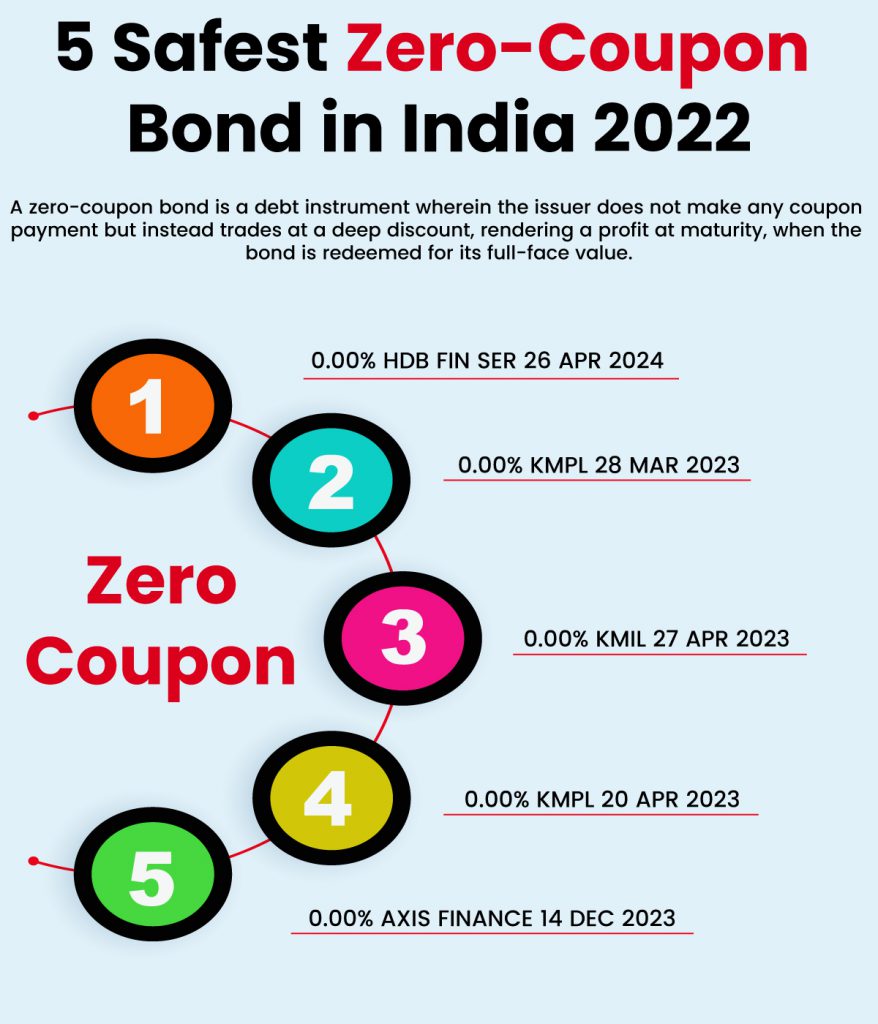

› terms › zWhat Is a Zero-Coupon Bond? - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Zero coupon bond face value

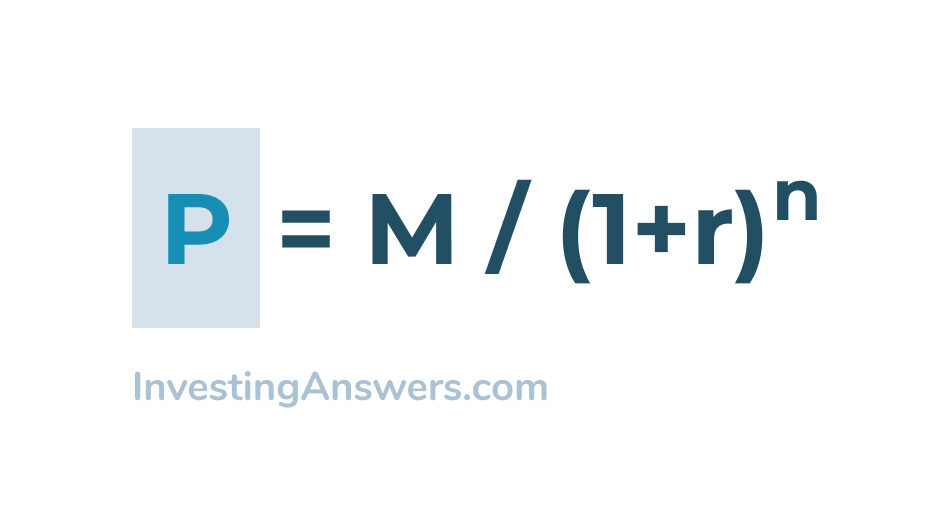

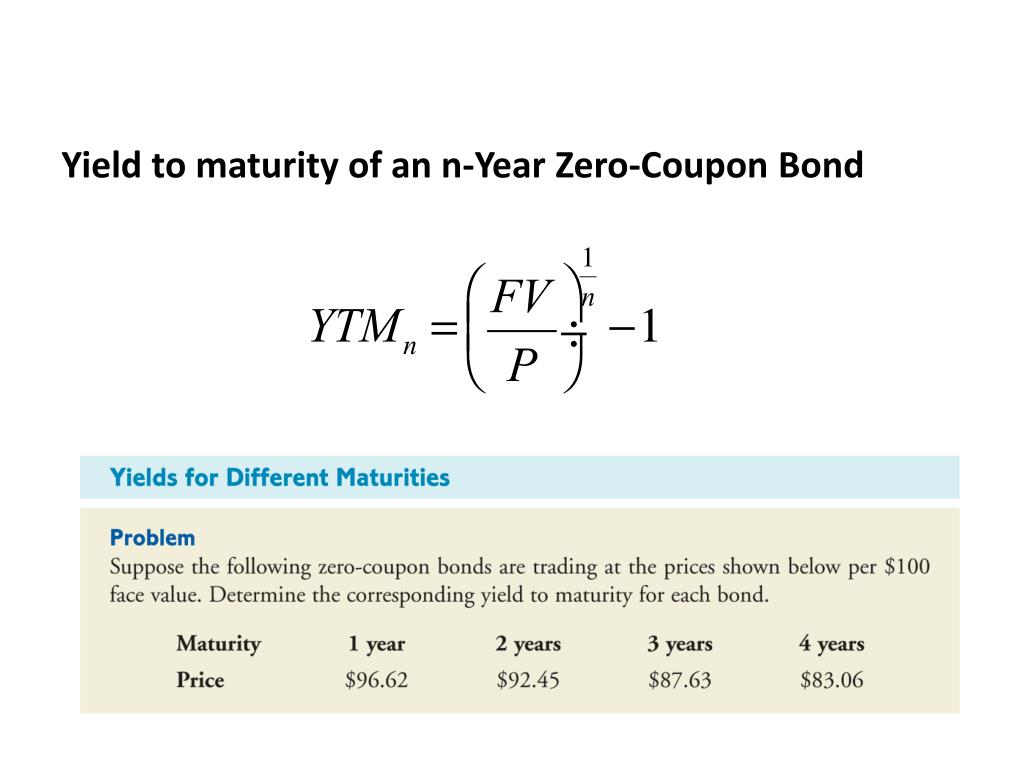

› zerocouponregularbondCoupon Bond Vs. Zero Coupon Bond: What's the Difference? Aug 31, 2020 · A zero-coupon bond does not pay coupons or interest payments like a typical bond does; instead, a zero-coupon holder receives the face value of the bond at maturity. dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Value? P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... › knowledge › zero-coupon-bondZero-Coupon Bonds: Characteristics and Calculation Example To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula. Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) – 1; Interest Rate Risks and “Phantom Income” Taxes

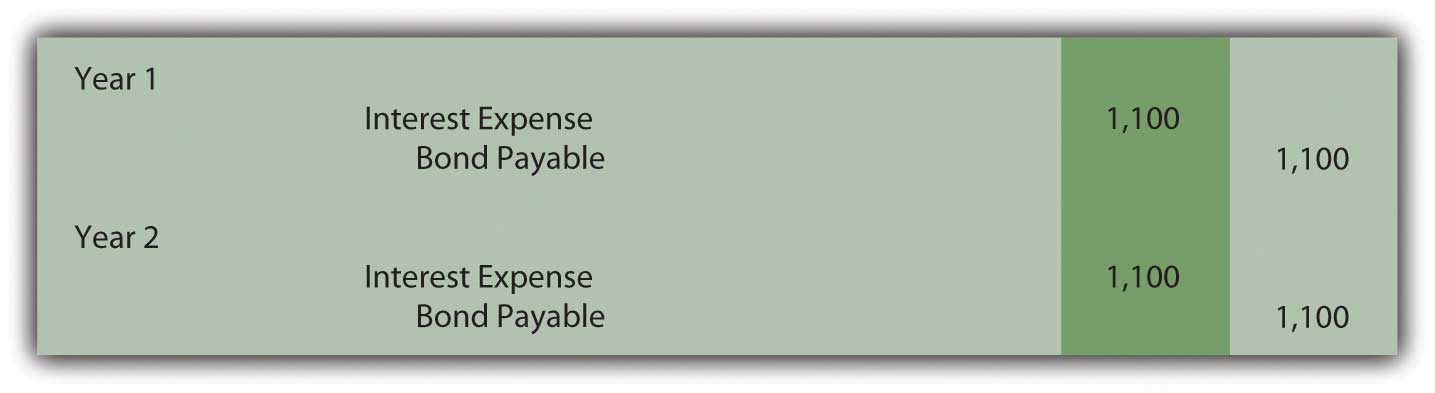

Zero coupon bond face value. › bonds-payableHow to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · Using the example above, if the issue was a 10 year zero coupon bond, then the price at issue would be given as follows: n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508) › knowledge › zero-coupon-bondZero-Coupon Bonds: Characteristics and Calculation Example To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula. Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) – 1; Interest Rate Risks and “Phantom Income” Taxes dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Value? P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ... › zerocouponregularbondCoupon Bond Vs. Zero Coupon Bond: What's the Difference? Aug 31, 2020 · A zero-coupon bond does not pay coupons or interest payments like a typical bond does; instead, a zero-coupon holder receives the face value of the bond at maturity.

Post a Comment for "44 zero coupon bond face value"