44 coupon rate bond formula

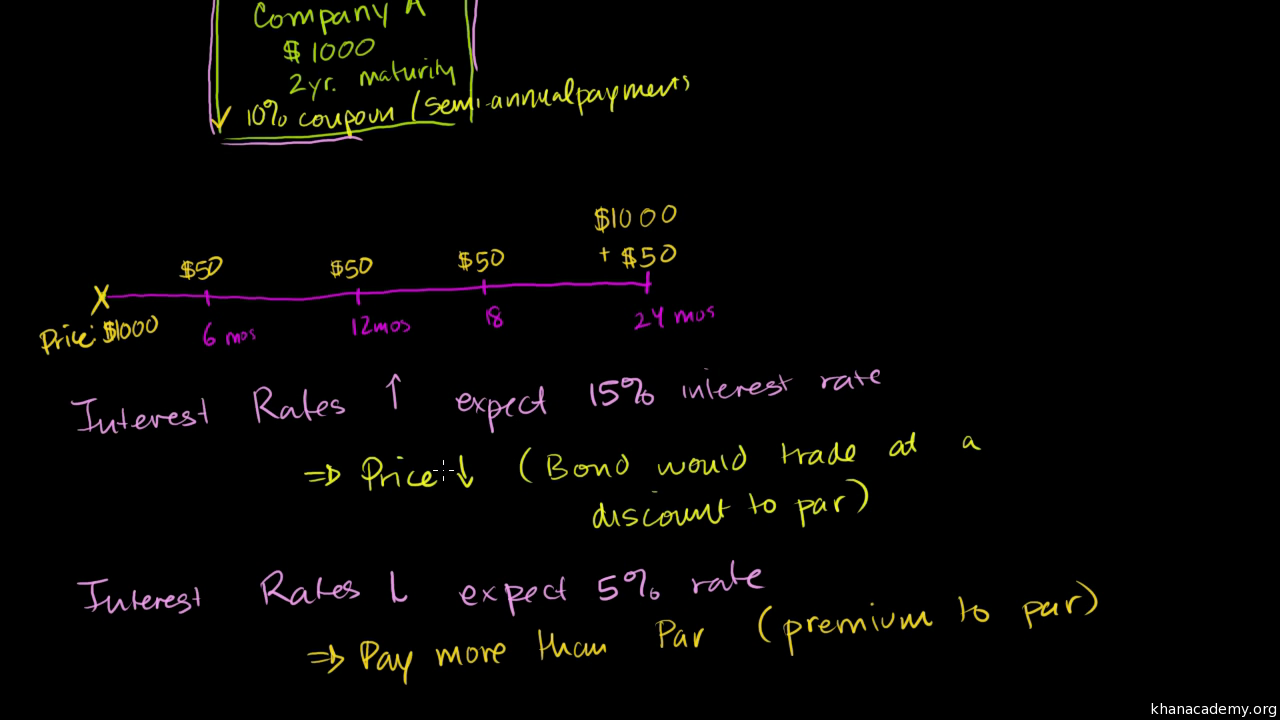

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA WebCoupon Rate Formula helps in calculating and comparing the coupon rate of differently fixed income securities and helps to choose the best as per the requirement of an investor. It also helps in assessing the cycle of interest rate and expected market value of a bond, for eg. If market interest rates are declining, the market value of bonds with higher interest … Coupon Rate Formula | Step by Step Calculation (with Examples) WebA bond trades at par when the coupon rate is equal to the market interest rate. Recommended Articles. This has been a guide to what is Coupon Rate Formula. Here we learn how to calculate the Coupon Rate of the Bond using practical examples and a downloadable excel template. You can learn more about Accounting from the following …

What Is a Bond Coupon, and How Is It Calculated? - Investopedia Web02.04.2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value.

Coupon rate bond formula

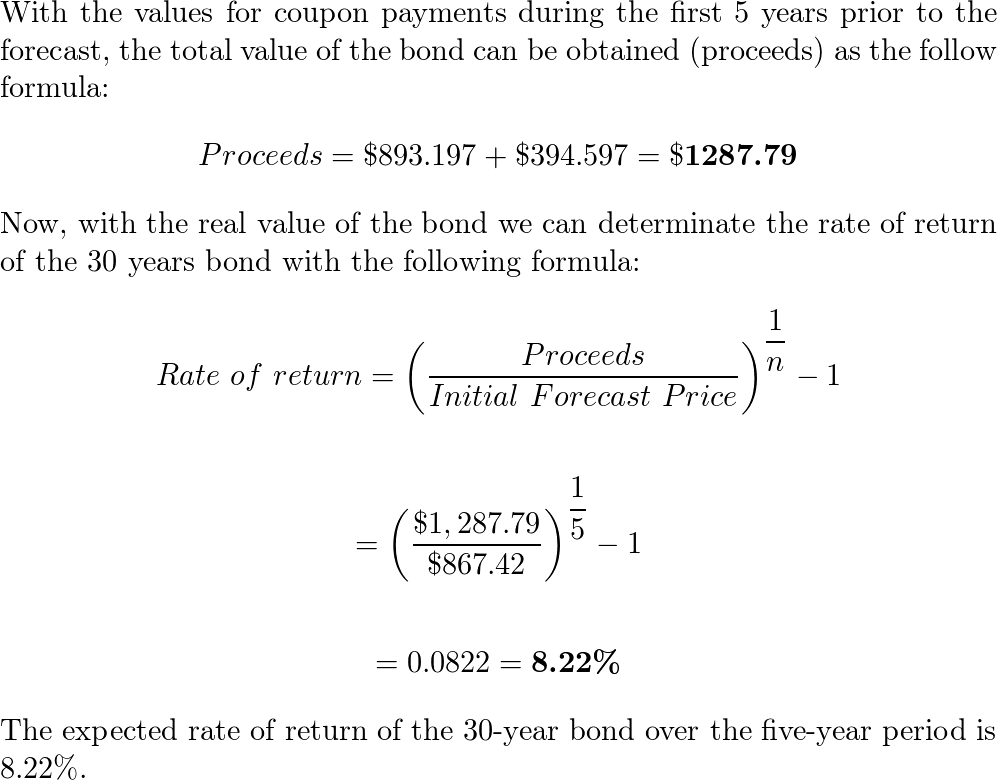

Coupon Bond Formula | Examples with Excel Template - EDUCBA WebIn case a bond offers a lower coupon rate than the market, the bond investor intends to bring down the price of the bond so its return matches the market return. Inherently, investors are attracted to bonds with higher coupon rates. So, as more and more investors purchase these high yield bonds and push the prices up which eventually brings its return … What Is the Coupon Rate of a Bond? - The Balance Web18.11.2021 · The formula to calculate a bond’s coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Rate of Return Formula | Calculator (Excel template) - EDUCBA WebIn this formula, any gain made is included in formula. Let us see an example to understand it. Rate of Return Formula – Example #3. An investor purchase 100 shares at a price of $15 per share and he received a dividend of $2 per share every year and after 5 years sell them at a price of $45.

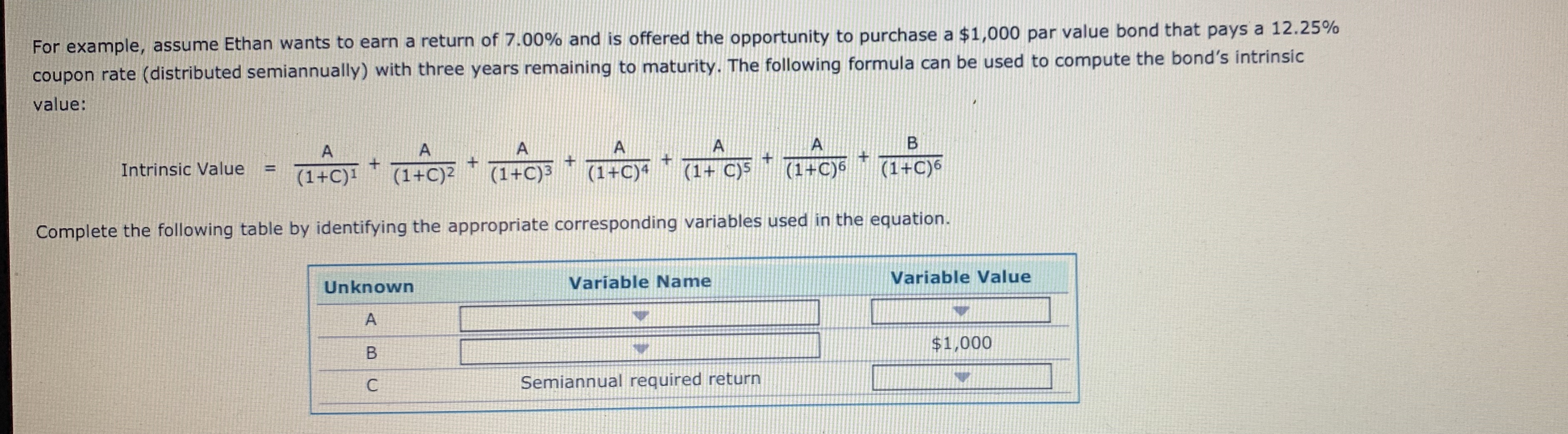

Coupon rate bond formula. Required Rate of Return Formula | Calculator (Excel template) Required Rate of Return = (2.7 / 20000) + 0.064; Required Rate of Return = 6.4 % Explanation of Required Rate of Return Formula. CAPM: Here is the step by step approach for calculating Required Return. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate ... Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo WebFinally, the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by 100%, as shown below. Examples. Let us take the example of a bond with quarterly coupon payments. Let us assume a company XYZ Ltd has issued a bond having a face value of $1,000 and … Bond Formula | How to Calculate a Bond | Examples with Excel … WebBond Formula – Example #2. Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50 . Zero-Coupon Bond: Definition, How It Works, and How To Calculate Web31.05.2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Rate of Return Formula | Calculator (Excel template) - EDUCBA WebIn this formula, any gain made is included in formula. Let us see an example to understand it. Rate of Return Formula – Example #3. An investor purchase 100 shares at a price of $15 per share and he received a dividend of $2 per share every year and after 5 years sell them at a price of $45. What Is the Coupon Rate of a Bond? - The Balance Web18.11.2021 · The formula to calculate a bond’s coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate.

Coupon Bond Formula | Examples with Excel Template - EDUCBA WebIn case a bond offers a lower coupon rate than the market, the bond investor intends to bring down the price of the bond so its return matches the market return. Inherently, investors are attracted to bonds with higher coupon rates. So, as more and more investors purchase these high yield bonds and push the prices up which eventually brings its return …

Post a Comment for "44 coupon rate bond formula"