41 step up coupon bonds

What Is a Step-up Bond? - The Balance But suppose you had a step-up bond that offered 0.5% annual coupon increases. The step-up feature gives you some protection against rising interest rates. After year one, you could earn 3.5%. After year two, you'd receive 4%, and so on. However, there's no guarantee that step-ups will keep up with market rates. How Step-up Bonds Work › coupon-rate-formulaCoupon Rate Formula | Step by Step Calculation (with Examples) Formula to Calculate Coupon Rate. Coupon Rate Formula is used for the purpose of calculating the coupon rate of the bond and according to the formula coupon rate of the bond will be calculated by dividing the total amount of annual coupon payments with the par value of the bonds and multiplying the resultant with the 100.

efinancemanagement.com › sources-of-finance › bondsAll the 21 Types of Bonds | General Features and Valuation | eFM Jun 13, 2022 · Step-Up Bonds. The step-up bonds are where the coupon usually steps up after a certain period. They may also be designed to step up not once but in a series. Such bonds are usually issued by companies where revenues/ profits are expected to grow in a phased manner. These are also called dual coupon or multiple coupon bonds. Step Down Bonds. The ...

Step up coupon bonds

How to calculate the yield to maturity for a step-up coupon bond - Quora Answer (1 of 2): If you want to give me the cusip and the dollar price, I can do it for you on Bloomberg, otherwise you can plot the cash flows on your own and use your calculator or Microsoft excel Internal rate of return function. But here's the thing, the vast majority of step-up notes do NOT ... What is a Step-Up Bond? - Accounting Hub A step-up bond comes with a lower interest rate initially. Its interest rate steps up after a specific period as described by the issuer. The interest rate of this bond can increase over specified intervals and up to a specified extent. It can be a single increase in the interest rate and several hikes depending on the terms of the bond. Types of bonds based on cash flows - Fixed Income - AlphaBetaPrep A step-up coupon bond is a bond, either fixed or variable, whose spread increases incrementally over the life of the bond. Bonds with step-up coupons offer protection against rising market interest rates. It is because when market interest rates increase, the bond's coupon rates also increase thereby limiting any decrease in bond value. ...

Step up coupon bonds. Novartis stirs debate with first social-linked step-up coupon bond Novartis stirs debate with first social-linked step-up coupon bond. Jon Hay , Mike Turner. September 17, 2020 10:00 PM. Sustainability-linked bonds took a full year to get going after Enel, the ... B step up note C zero coupon bond Explanation Deferred coupon bonds ... B step up note C zero coupon bond Explanation Deferred coupon bonds carry. B step up note c zero coupon bond explanation. School Oxford Brookes; Course Title MARKETING 4001; Uploaded By solomongoredema. Pages 958 This preview shows page 630 - 633 out of 958 pages. What are Step-up Bonds? Example, Types, Advantages, and ... - CFAJournal Step-up bonds are the type of bonds that come with a variable increasing coupon rate. These are better than fixed-income bonds, and allow lenders to get a higher interest on the bond. There are two main types of step-up bonds, single step-up and multiple step-up bonds. See also IPO Process: 5 Key Process You Should Know Finance | Step-Up Bond Step-Up Coupon Bond. A bond with interest coupons that change to preset levels on specific dates. More specifically, the bond pays a given coupon for a specific period of time, then its coupon is stepped up in regular periods until maturity. For instance, a bond may pay 6% interest for the next five years, and thereafter interest payment ...

Step-Up Bond Definition - Investopedia Because the coupon payment increases over the life of the bond, a step-up bond lets investors take advantage of the stability of bond interest payments while benefiting from increases in the coupon... Step-Up Bonds Definition & Example - InvestingAnswers A step-up bond is a bond with a coupon that increases ('steps up'), usually at regular intervals, while the bond is outstanding. Step-up bonds are often issued by government agencies. How Do Step-Up Bonds Work? Let's consider a five-year step-up bond issued by Company XYZ. A indexlinked bonds b deferred coupon bonds c stepup Step‐up coupon bonds. Answer: C Typically, the step up coupon structure is offered with callable bonds to protect bondholders in a rising interest rate environment. If interest rates rise, it becomes increasingly unlikely that the issuer will call the bond, so the step‐up feature at least allows investors to benefit from highercoupons. 93. Telco Step-Up Coupon Bonds Touted - globalcapital.com As of last Wednesday, France Telecom's 6.75% of '08, which features a step-up was trading at 155 over swaps, while the company's 6.625% of '10 plain vanilla bond, was at 119 over. Deutsche...

› vouchers › step-oneStep One Discount Codes: 10% Off - July 2022 - Groupon Enjoy Exclusive Discounts and Offers when you Sign Up for The Newsletter at Step One: Online Deal: 19 Sep 2022: Shop Boxer Briefs From Just $21! at Step One: Online Deal: 23 Aug 2022: Get 4 Pairs For Just $27 with this Step One Mix N Match Promo: Online Deal: 28 Aug 2022: Get up to 40% Off Boxers! Shop From $12.60 at Step One: Online Deal: 10 ... Step-Up Coupon Securities financial definition of Step-Up Coupon Securities Thus, a stepped coupon bond might pay 9% interest for the first 5 years after issue and then step up the interest every fifth year until maturity. Issuers often have the right to call the bond at par on the date the interest rate is scheduled to change. Also called dual coupon bond, rising-coupon security, step-up coupon security. Step-Coupon Bond - Fincyclopedia In this sense, a step-coupon bond is similar in structure to a deferred-interest bond ( DIB) except that it is initially issued with a low coupon interest, which is later readjusted upward. A step-coupon bond may have an embedded call option which the issuer can exercise as the coupon level rises. This bond is also known as a reset bond. S 703 Step-Up Bonds | Meaning, Single, Multiple, Callable Bonds, Benefits-Risks Step-up bonds or step-up notes are securities with a coupon rate that increases over time. These securities are called step-up bonds because the coupon rate "steps up" over time. For example, the step-up bond could have a 5% coupon rate for the first two years, 5.5% for the third and fourth years, and 6% for the fifth year.

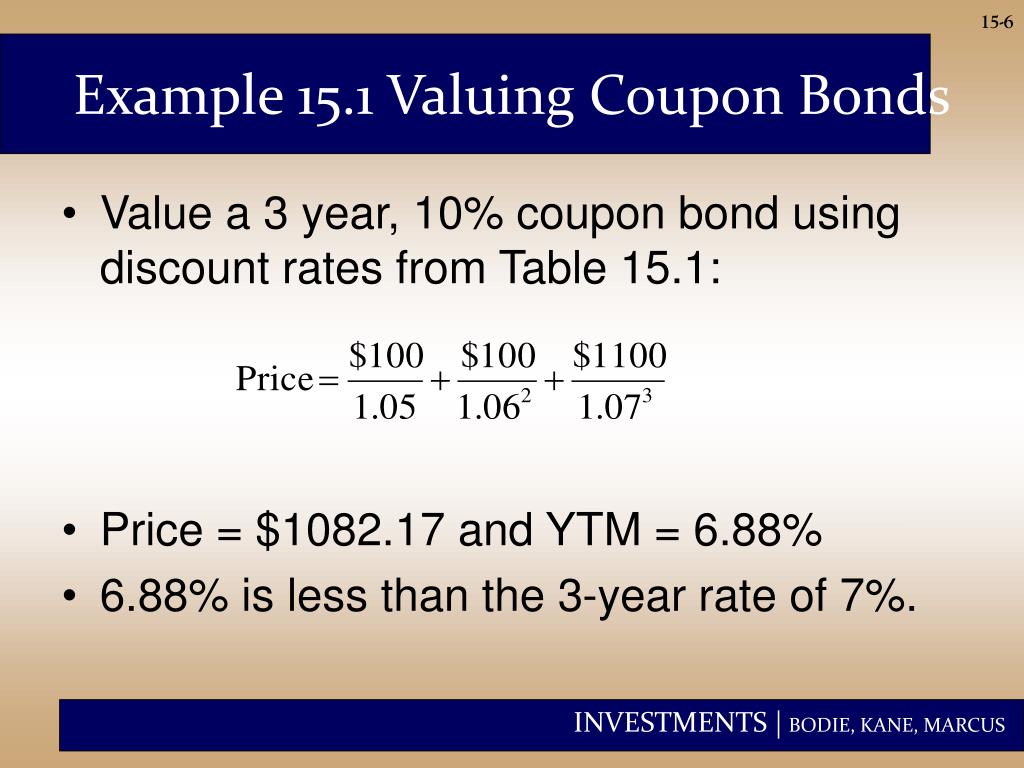

› Calculate-Annual-Interest-on-Bonds3 Ways to Calculate Annual Interest on Bonds - wikiHow Mar 29, 2019 · Interest is paid semi-annually, so the coupon rate per period is 5 percent (10 percent / 2) and the market interest rate per period is 4 percent (8 percent / 2). The number of periods is 10 (2 periods per year * 5 years). The coupon payment per period is $25,000 ($500,000 *.05). Calculate the present value of the principal.

PDF An Analysis of Step-Up Fixed Income Securities The step-ups may not be better than a fixed income bond. If what drew you to the step-up was those big yield numbers, think again. Considerations What are some of the considerations in purchasing these step-up ... Step-Up CD Date- Coupon Rate Actual Yield to Date Actual Yield to Date 01/20/2017 - 2.000% 2018 - 2% 2018 - 1% ...

Accounting for Step-Up Bond - Advantage - Accountinguide Step Up Bond provide benefit to the holders while having some negative impact on the issuers. Step Up Bond Example Company ABC issues the step-up bond at $ 1,000 per bond. The initial coupon rate was 2%, and it will keep increasing 50% every year over the 5 years lifetime.

Deferred Coupon Bonds: Definition, How It Works, Types and More Step-Up Bonds These bonds do not make coupon payments until a certain period. For instance, a bond can start interest payments after 5 years with a 10 year maturity period. Toggle Notes Toggle notes pay increased interest rates after a certain period. Investors expect higher interest rates with a deferred payment condition.

› Purchase-Municipal-BondsHow to Purchase Municipal Bonds: 13 Steps (with Pictures) Jun 01, 2021 · A mutual fund can invest in many different municipal bonds at the same time, and you can own a share of that collection of bonds by buying shares of the fund. [14] X Trustworthy Source Financial Industry Regulatory Agency Non-governmental organization responsible for regulating brokerage firms and exchange markets Go to source The people who ...

Coupon Bond - Investopedia A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of...

Step-Up Coupon Bond - Harbourfront Technologies A step-up coupon bond, or step-up bond, is a debt instrument that pays comes with a lower initial interest rate. However, it includes a feature that provides increasing rates after specific periods. There is no standard for step-up bonds to follow when it comes to interest rate increases.

Deferred Coupon Bonds | Definition, How it works? Types, Advantages Deferred Coupon bonds help businesses acquire finance without paying periodic interest. A lump-sum is paid including interest at the time of maturity. ... a company paying 4% interest on step-up bonds defers interest payments till maturity. On maturity, the company will pay interest at an increased rate (say) 5.5% for all the deferred periods. ...

Step-Up & Step-Down Bond - Cbonds.com Step-Up and Step-Down bonds are fixed-rate bonds characterized by a trend, determined at the issue of the bond itself, which may be respectively increasing or decreasing over time. The typical predetermined coupon structure or variable over time represents this peculiar characteristic common to both types of bonds. Example of a bond.

Step-Ups - Types of Fixed Income Bonds - Raymond James Financial Introduction to Step-up Bonds: At the most basic level, step-up bonds have coupon payments that increase ("step-up") over the life of the bond according to a predetermined schedule. In most cases, step-ups become callable by the issuer on each anniversary date that the coupon resets or continuously after an initial non-call period.

Stepped coupon bond financial definition of stepped coupon bond A bond with interest coupons that change to predetermined levels on specific dates. Thus, a stepped coupon bond might pay 9% interest for the first 5 years after issue and then step up the interest every fifth year until maturity. Issuers often have the right to call the bond at par on the date the interest rate is scheduled to change.

What Do I Need to Know About Step-Up Bonds? - Zacks Investment Research One-step bonds have their coupon payment stepped up once during the life of the bond. For example, the coupon payment on a five-year bond may be 5 percent in the first and second years, then go to...

› terms › sStep-Up in Basis Definition - Investopedia Mar 30, 2022 · Step-up in basis is the readjustment of the value of an appreciated asset for tax purposes upon inheritance, determined to be the higher market value of the asset at the time of inheritance. When ...

Calling munis is too pricey | Bond Buyer The combined cashflows of the 3.50% callable bond and the 2.61% refunding bond will be the same as that of the step-up coupon bond. Clearly the issuer should prefer the 3% optionless bond to the 3 ...

› terms › zZero-Coupon Bond Definition - Investopedia Nov 11, 2021 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

More Coupon Step-Ups Likely Among Onshore Chinese Bonds - Fitch Ratings We counted 84 bonds that stepped up coupon rates by 2bp to 225bp on their put or call dates in 8M20, accounting for 8.7% of a total of 962 bonds with exercisable coupon-adjustment provisions bundled with put options or perpetual features. In contrast, 568 bonds, or about half of the bonds with exercisable coupon-adjustment provisions, offered ...

Answered: a) Company PLU decides to issue bond to… | bartleby Plain vanilla bond; Step-up coupon bond; Deferred coupon bond; Credit linked coupon bond (b) An affirmative covenant is most likely to stipulate: 1) Limits on the issuer's leverage ratio. 2) How the proceeds of the bond issue will be used. 3) The maximum percentage of the issuer's gross assets that can be sold.

Post a Comment for "41 step up coupon bonds"