41 how to find the coupon rate of a bond

› terms › bBond Definition - Investopedia Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... en.wikipedia.org › wiki › Floating_rate_noteFloating rate note - Wikipedia Floating rate notes (FRNs) are bonds that have a variable coupon, equal to a money market reference rate, like LIBOR or federal funds rate, plus a quoted spread (also known as quoted margin). The spread is a rate that remains constant.

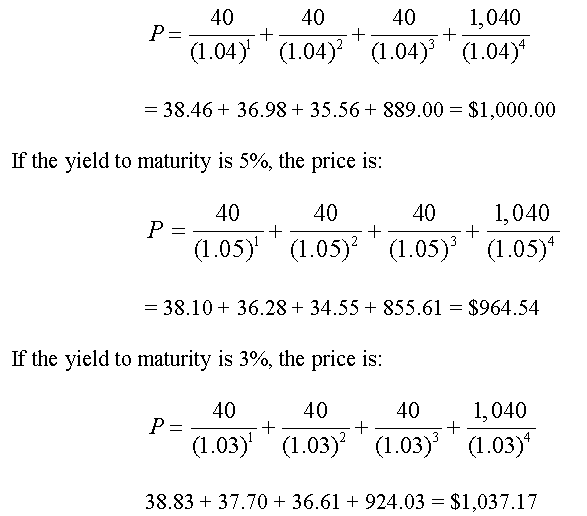

Fixed rate bond valuation - Breaking Down Finance The following formula demonstrates how a fixed rate bond can be valued. For example, consider a bond with a face value of 1000, 5 years to maturity and an annual coupon rate of 5% (paid on an annual basis). The future cash flows in year 1 to year 4 will then be 5% of 1000: 50. The cash flow in the fifth year will be equal to 1050 since the ...

How to find the coupon rate of a bond

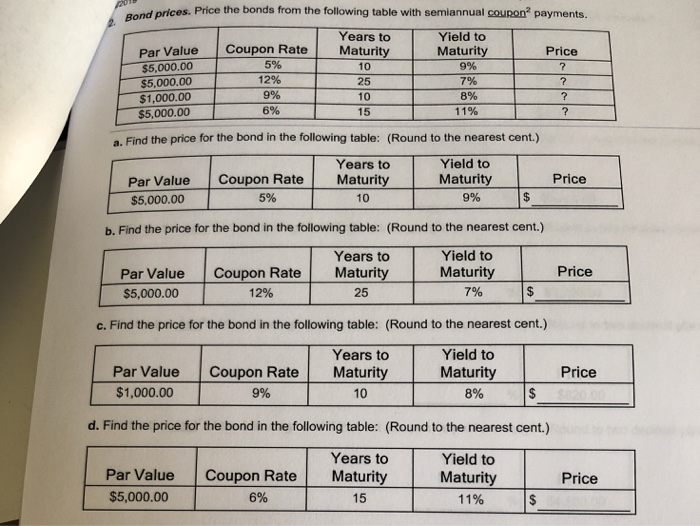

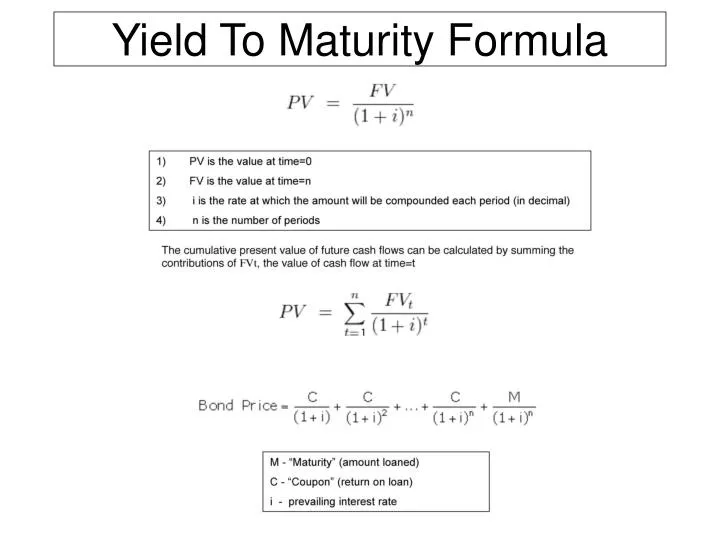

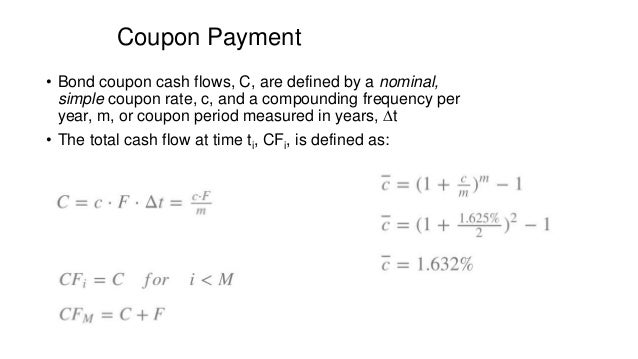

How To Find Coupon Rate Of A Bond On Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator. Bond Price Calculator The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link

How to find the coupon rate of a bond. www2.asx.com.au › bond-derivativesBond derivatives - Australian Securities Exchange For each bond in the bond basket, ASX will take the best bid and best offer available in the market by reference to live market prices taken from bond trading venues as determined by the Exchange. Average of the best bid and best offer for each bond will be calculated at 9:00am, 9:45am, 10:30am and 11:15am. › ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ... What is a Coupon Rate? | Bond Investing | Investment U Calculating a bond's coupon rate comes down to examining its par value and its yield. Specifically, investors would divide the sum of annual interest payments by the par value: Coupon Rate = Total Coupon Payments / Par Value For example, if a company issues a $1,000 bond with two $25 semi-annual payments, its coupon rate would be $50/$1000 = 5%. Coupon Bond - Guide, Examples, How Coupon Bonds Work Nevertheless, the term "coupon" is still used, but it merely refers to the bond's nominal yield. How Does a Coupon Bond Work? Upon the issuance of the bond, a coupon rate on the bond's face value is specified. The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These ...

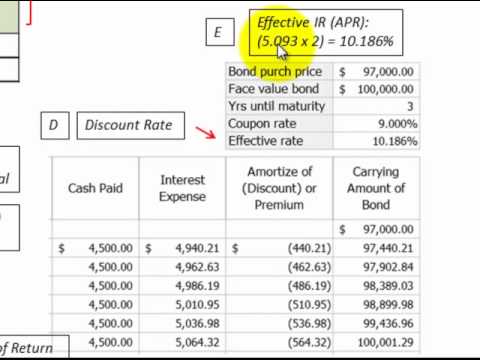

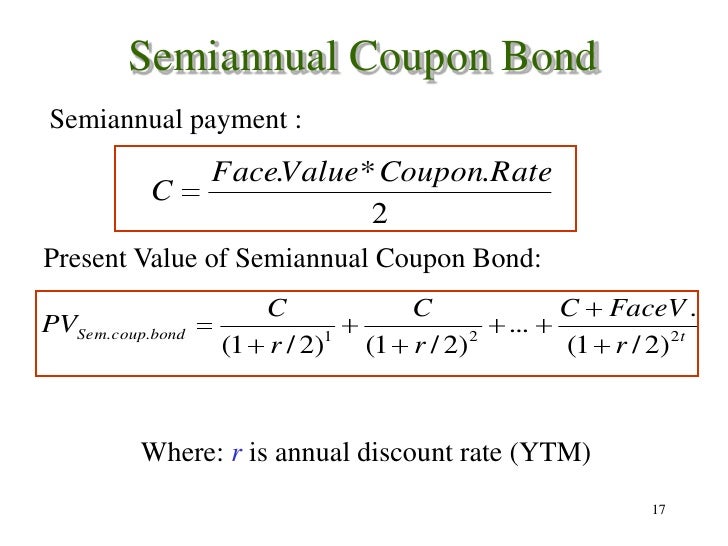

What Is the Coupon Rate of a Bond? - The Balance Coupon Rate Formula The formula to calculate a bond's coupon rate is very straightforward, as detailed below. The annual interest paid divided by bond par value equals the coupon rate. As an example, let's say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. How do you calculate discount factor? - Ufoscience.org A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. einvestingforbeginners.com › bond-valuation-daahBond Valuation Overview (With Formulas and Examples) Aug 20, 2021 · For example, let’s find a corporate bond value with an annual interest rate of 5%, making semi-annual payments. After two years, the bond matures and repays the principal. For our purposes, let’s assume a yield to maturity of 3%. Face value of the corporate bond = $1000 Annual coupon rate = 5%, therefore, semi-annual coupon rate = 5%/2 = 2.5%

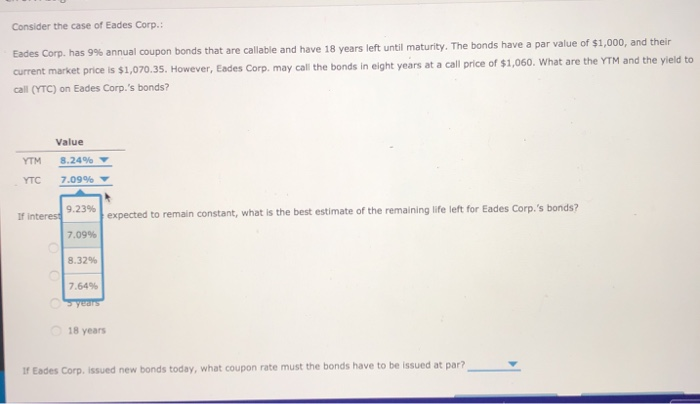

What is the difference between YTM and coupon rate? The YTM calculation takes into account: coupon rate, the price of the bond, time remaining until maturity, and the difference between the face value and the price. It is a rather complex calculation. The coupon rate, or, more simply stated, coupon of a particular bond, is the amount of interest paid every year. How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a... Coupon Bond Formula | Examples with Excel Template Mathematically, the formula for coupon bond is represented as, Coupon Bond = ∑ [ (C/n) / (1+Y/n)i] + [ F/ (1+Y/n)n*t] or Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] where, C = Annual Coupon Payment, F = Par Value at Maturity, Y = Yield to Maturity, n = Number of Payments Per Year t = Number of Years Until Maturity Series I Savings Bonds Rates & Terms: Calculating Interest Rates Series I Savings Bonds Rates & Terms: Calculating Interest Rates. NEWS: The initial interest rate on new Series I savings bonds is 9.62 percent. You can buy I bonds at that rate through October 2022. Learn more.. KEY FACTS: I Bonds can be purchased through October 2022 at the current rate. That rate is applied to the 6 months after the purchase is made.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

What Is a Coupon Rate? How To Calculate Them & What They're Used For Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder.

How is the coupon rate of a bond calculated? - Quora Coupon rate is the interest rate of the bond at face value (par value). Suppose you buy a bond at face value of $1000 and the coupon rate is 10%. So, every year, you'll receive $100 (10% of $1000). However, if you bought the bond above its face value, say at $2000, you will still receive a coupon of 10% on the face value of $1000.

How is YTM related to coupon rate? - Skinscanapp.com A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, or the stated value of the bond at the time of issuance, as determined by the issuing entity. Most bonds have par values of $100 or $1,000.

Find the duration of a bond with a settlement date of | Chegg.com Round your answers to 4 decimal places.) Question: Find the duration of a bond with a settlement date of May 27, 2023, and maturity date November 15, 2034. The coupon rate of the bond is 6.0%, and the bond pays coupons semiannually. The bond is selling at a bond-equivalent yield to maturity of 7.0%. Use Spreadsheet 16.2.

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest.

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000...

› bond-basics-417057Bond Basics: Issue Size and Date, Maturity Value, Coupon May 28, 2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures.

Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

› Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73.

How to Find the Interest Rate on a Bond - The Nest Look up the price you paid for the bond in your financial records. Divide the coupon rate in dollars by the purchase price of the bond and multiply the result by 100 to convert to a percentage interest rate. Suppose you paid $4,500 for a bond with face value of $5,000 and a coupon rate of $300. You have ($300/$4,500) * 100 = 6.67 percent.

How to Calculate the Bond Duration (example included) Therefore, for our example, m = 2. Here is a summary of all the components that can be used to calculate Macaulay duration: m = Number of payments per period = 2. YTM = Yield to Maturity = 8% or 0.08. PV = Bond price = 963.7. FV = Bond face value = 1000. C = Coupon rate = 6% or 0.06.

How to Calculate a Coupon Payment: 7 Steps (with Pictures) If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment is .08 * 1000 or $80. [6] 2

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The issuer makes periodic interest payments until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template

Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time!

How do you calculate the interest rate of a bond? For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. How do you calculate annual interest on a bond? Multiply the bond's face value by the coupon interest rate. For example, if the bond's face value is $1000, and the interest rate is 5%, by multiplying 5% by $1000, you can find out ...

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM).

:max_bytes(150000):strip_icc()/bond_duration-5bfc37fd46e0fb00260e7d1c.jpg)

Post a Comment for "41 how to find the coupon rate of a bond"